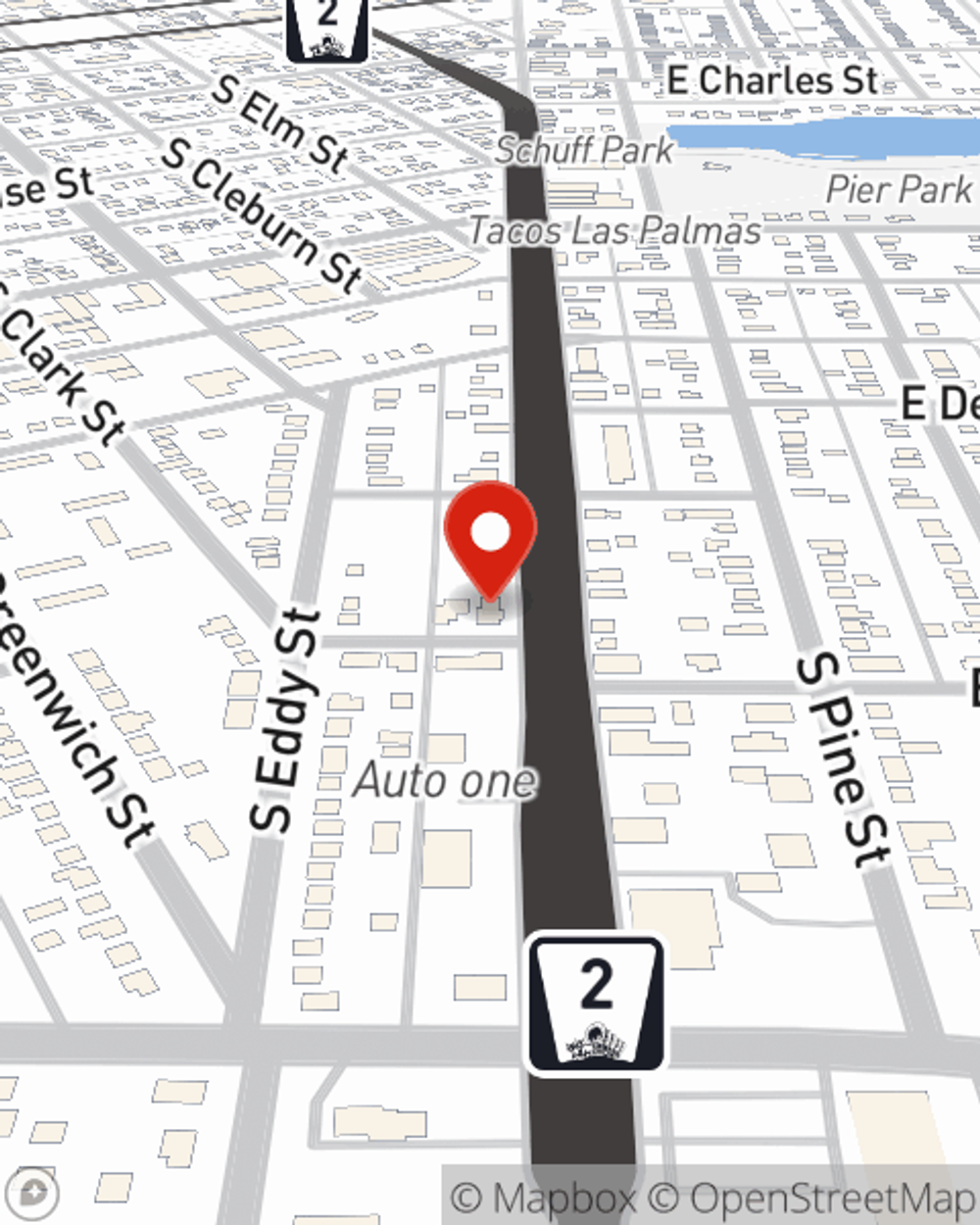

Business Insurance in and around Grand Island

Looking for small business insurance coverage?

No funny business here

State Farm Understands Small Businesses.

Whether you own a a stained glass shop, a cosmetic store, or a pet groomer, State Farm has small business protection that can help. That way, amid all the different moving pieces and options, you can focus on making this adventure a success.

Looking for small business insurance coverage?

No funny business here

Insurance Designed For Small Business

Your small business is unique and faces a different set of challenges. Whether you are growing an interpreter or an acting school, State Farm provides a large range of small business insurance options to help your business thrive. Depending on your layout, you may need more than just business property insurance. State Farm Agent Ty Benton can help with worker's compensation for your employees as well as professional liability insurance.

With over 300+ businesses eligible to be insured by State Farm, look no further for your business coverage needs. Agent Ty Benton is here to help you learn about your options. Call or email today!

Simple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

Ty Benton

State Farm® Insurance AgentSimple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.